31 Oct Tax Strategies Post-Election

No matter who is elected (or re-elected) on November 3, estate planning tax strategies post-election will need to be reassessed. Phelps LaClair is a second generation estate planning law firm serving Chandler, Mesa, Phoenix and Scottsdale. Helping our clients to navigate changing tax laws is a major concern for us. The Tax Cuts and Jobs Act (TCJA) passed in December of 2017 made significant changes to individual income tax deductions and tax rates which benefited most Americans. These changes are due to expire in 2025, but could they be changed sooner?

TCJA Advantages and Disadvantages

According to the Tax Foundation, 28.5 million filers were better off taking the expanded standard tax deduction in 2020. In addition to saving money, they also saved time required for filing tax returns. There were lower marginal tax rates across the board, and better child tax credits. For estate taxes, the basic exclusion for assets was doubled to $11.58 million per individual. It is twice that for married filing jointly.

There were some disadvantages, however. There were limits to some itemized deductions to reduce distortions in the tax code. Among these were deductions for mortgage interest and state and local taxes. The changes are set to expire at the end of 2025. In 2026, most households will see a significant increase in the amount of taxes they will need to pay.

Subject to Change

These tax laws could be changed by the winner of the November 3rd election. As President Trump is the one who sought these changes, it is unlikely that the Republican candidate will end TCJA early.

The plan offered by the Democratic candidate will do away with the program. This means that the higher tax rate of 45% would be triggered by assets of around $3.5 million. The Democrats would also eliminate the step up in basis. This would cause unrealized capital gains to be taxed at death. In addition, their tax plan would lead to 1.9% to 7.7% less after-tax income. Corporate taxes would increase, and a 12.4% Social Security payroll tax would be imposed on individuals earning more than $400,000.

Tax Strategies Post-Election

In every election year there are changes that will result from changes in government administrations. This year is no exception. It will be to your advantage to keep abreast of all changes to the tax code. At Phelps LaClair, we can help you with that. We design every estate plan to take advantage of all available tax-saving possibilities. Tax strategies post-election will be significantly impacted by a change in administration. For more information, give us a call. We are here to ensure your peace of mind when it comes to protecting your assets.

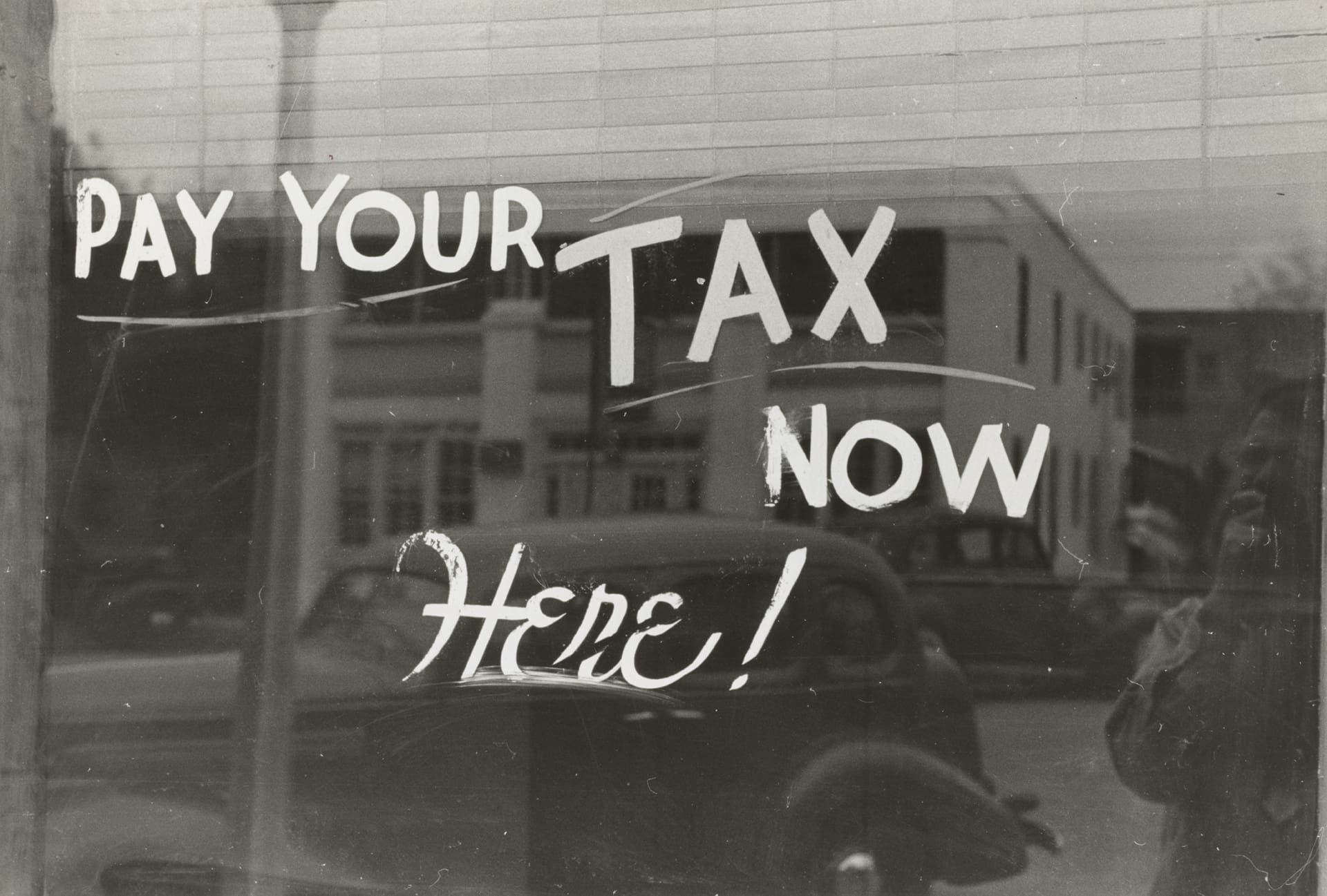

Images used under creative commons license (Commerical Use) 10/31/20 Photo by The New York Public Library on Unslpash