Our breakthrough strategy: For many of our clients, their IRA (or other company retirement plan that may someday be rolled over into an IRA) is their largest asset other than their home. Indeed, thanks to tax-deferred compounding, an IRA tends to grow more rapidly over time than any other asset.

Have you ever considered how to best pass on your IRA to your children or grandchildren in a way that allows them to also defer taxes on the money after you die? With good planning, your retirement account can become a tax-favored retirement account for your loved ones after you die.

The long-term value of a properly planned IRA

If you have an IRA (or company retirement plan), you should know that, based on recent IRS regulations, you have the ability to defer the income taxable minimum distributions over a long period of time – over your lifetime plus an additional 10 years after your beneficiaries inherit the account (or even longer for minor or disabled beneficiaries). This 10-year “stretch-out” can be a significant tax benefit to your beneficiaries.

The challenges: Stretch-out and Protection

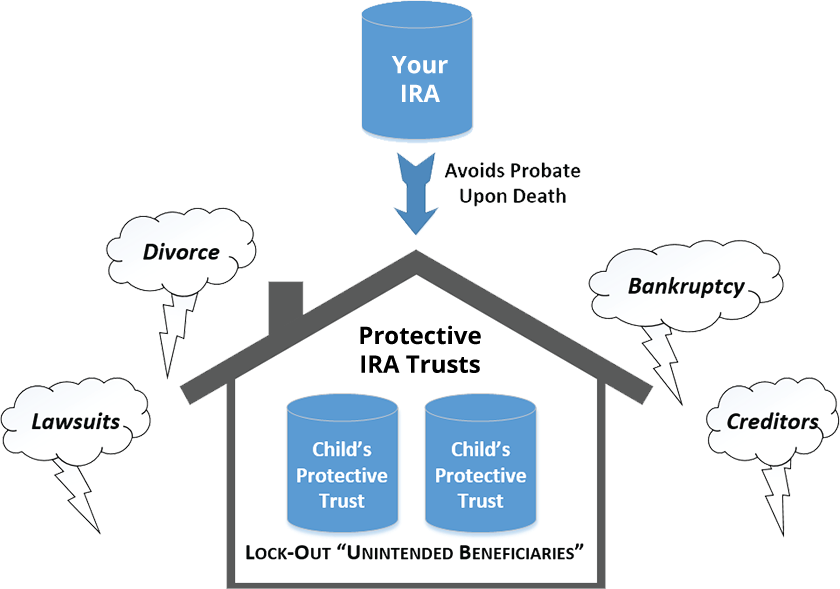

Unfortunately, the 10-year stretch-out of your IRA is not automatic. Your beneficiaries must make the right income tax elections and take out the required minimum distributions at the right time and in the right way. Without proper planning and direction, your IRA account could be carelessly spent by your child, or worse yet, his or her spouse may take a big chunk of it in a divorce. Plus, your IRA can be grabbed by the creditors of your beneficiaries, because of an accident, a lawsuit, a financial setback or bankruptcy. In short, when your IRA goes directly to your child (or other named beneficiaries) there is nothing to protect it from these lurking problems, and the money will be gone within a short time.

The solution: The IRA Inheritance Trust

Based upon recent IRS regulations and rulings, there is now a way to properly protect your IRA after you die – the IRA Inheritance Trust. Phelps LaClair and its team of experienced tax attorneys who understand the complex IRS distribution rules is uniquely equipped to offer this ground-breaking trust. This powerful, cutting-edge planning technique has received a favorable published ruling from the IRS.

How the trust works

Think of it as a revocable living trust designed specifically for your IRA. It is a revocable trust set up separately from your Living Trust. The IRA Inheritance Trust is then named the primary or secondary beneficiary of your IRA (or company retirement plan), but you remain the owner in full control during your lifetime. You can also make changes to the trust during your lifetime. When you pass away, your IRA distributions pour over into the IRA Inheritance Trust. The trust can then help assure the maximum tax “stretch-out” and better protect your spouse, children, and grandchildren from the influence and claims of spouses, caretakers, unwanted third parties, lawsuits and creditors!

If you have IRAs (plus company retirement plans) totaling over $150,000, you owe it to yourself and your loved ones to learn more about this new IRA Inheritance Trust and how it may eventually save and protect literally millions of dollars for your family – and preserve their future quality of life.