12 Apr Protect Your Loved Ones With the Protective Inheritance Trust

During the 40-plus years that Phelps LaClair has been designing and implementing Arizona Living Trusts, our real life experience has proven that a Living Trust is not just a bunch of words on paper; rather, a Living Trust is a critical tool that makes the difference between your hard-earned assets being a blessing in the lives of your loved ones, or a curse. Your Living Trust will make life simple on your loved ones and save them significant time and money by avoiding probate. That alone is reason enough to do a trust! We want our local Gilbert, Mesa, Phoenix and Chandler community to be protected.

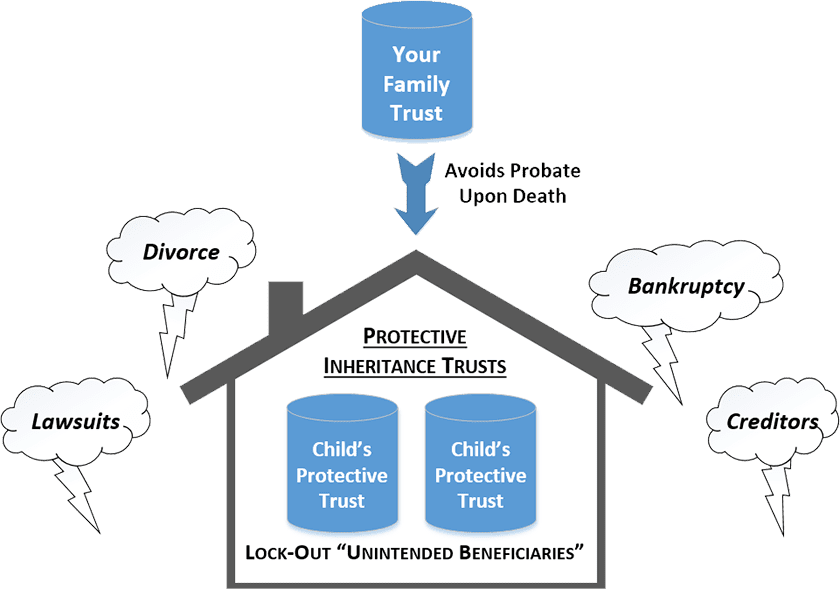

However, a typical Living Trust does not take into account what may happen to your money and assets if your loved ones come into hard times after you are gone.

We could tell you many stories, but here are two common scenarios we see happen after parents pass away:

- Divorce! Dad and Mom pass away with a trust that left a modest inheritance outright to their three married children. Like most beneficiaries, the youngest daughter put the money into a joint account with her spouse, and then she used some of the inheritance to help pay the mortgage, put the kids through school, etc. But the daughter set aside most of her inheritance for later retirement. The daughter had no idea that she had accidentally converted the inheritance to community property. When divorce happened 3 years later, guess who was awarded half the inheritance? The ex-husband. Divorce is the #1 killer of inheritances!

- Creditors and Lawsuits! Mom passes away with a trust leaving the inheritance outright for her responsible adult daughter. A few months later, the daughter has a business deal that turns south and is sued in Arizona state court for $1 million. The lawsuit is frivolous, but the jury is not convinced. The inheritance is gone! A Lawsuit can sneak up on most anyone – car accidents, homeowner claims, business claims, government claims – you name it.

These are just two common examples of many. So what went wrong? After all, the parents had raised good kids, and because of their Living Trust probate was avoided and it was smooth sailing at the time of death when the sky was clear. But at the end of the day, when crises struck months or years after the parents passed, the money ended up in the wrong hands.

The Protective Inheritance Trust (or “PIT”) is a good example of an estate planning strategy that protects clients from both the known and the unknown. If you have a Living Trust and have kept it up to date (we tell our clients to come see us every 3 years for a free trust review) you have taken care of the “knowns,” such as preparing for your death or incapacity. The “PIT” takes it a step further by preparing for the unknown: instead of the beneficiaries receiving their inheritance directly, why not keep the money in a special protective trust for them which springs out of your Living Trust when you die? With recent law changes, this Protective Inheritance Trust can be controlled by each beneficiary in a way that virtually gives him or her all of the same rights as outright ownership, without the liability exposures that ownership brings. A Protective Inheritance Trust is like leaving the money in a personal vault for each beneficiary. Only the beneficiary has the key to open and close the vault at will.

How Does the Protective Inheritance Trust Work?

With a “PIT,” your beneficiaries can receive the best of both worlds. On the one hand, the beneficiary may have full flexibility and control over his or her own Protective Inheritance Trust (if you wish) – the beneficiary may be his or her own trustee, control how the assets are invested, decide how and when money is distributed, and even direct who may receive the left-over assets when that beneficiary passes away. On the other hand, if a crisis is ever happening in the life of a beneficiary, the assets in the trust are protected because technically the beneficiary does not “own” the assets. For example, if a divorce happens, your child can “lock down” the trust assets from the attack of the ex-spouse. Yet even in this case, the beneficiary may continue to control his or her inheritance while enjoying additional asset protection.

What Makes Our Protective Inheritance Trust So Different?

Our Protective Inheritance Trust uniquely balances the desire for asset protection with the desire to allow your beneficiaries the most flexibility to control their inheritances and adapt the protection level as needed. The “PIT” is simple in its design and easy to understand and administer after you pass away so your beneficiary can feel comfortable using it.

The Protective Inheritance Trust: Innovative? Yes. New and untested? No.

The Protective Inheritance Trust is based upon over 100 years of asset protection law. We have merely taken advantage of some recent developments in Arizona law that allow us to adapt and import this technology into your Living Trust. The “PIT” is not what other attorneys may commonly refer to as a “Generation Skipping trust,” “Discretionary trust” or “Dynasty trust.” To our knowledge, the “PIT” strategy is only offered by a very small number of attorneys throughout the state.

Introduce a PIT into your Estate Plan Today

Phelps LaClair provides the Protective Inheritance Trust as just one feature of its complete Arizona Living Trust package – and the entire package costs only a fraction of the price many attorneys charge for an Asset Protection Trust alone. If you don’t have a Living Trust, or if your existing trust does not have the “PIT” feature, you should seriously consider doing so right away! We at Phelps LaClair believe that it’s so important, we now recommend the Protective Inheritance Trust as “standard equipment” in most every new Living Trust we do, and it is the most common “upgrade” we add to Living Trusts already in existence.

This is intended as a quick summary containing general information only and does not constitute legal advice. Before proceeding to set up a Protective Inheritance Trust, you should consult with a qualified attorney.