15 Oct The Basics of Wills and Living Trusts

Both a Living Trust and a Will are legal documents that state how you want your financial assets to be distributed after your death. But what’s the difference between a living trust and a last will and testament? Is one better for protecting future beneficiaries from loss and expense? Are both documents capable of shielding your finances? At Phelps LaClair, serving the Phoenix Valley in Arizona, we’ve helped two generations of families put these legal documents in place. Our more than 40 years of know-how has given us a pretty good understanding of what works and what doesn’t work. As a starting place for those who are new to estate planning, we’d like to introduce the basics of Wills and Living Trusts.

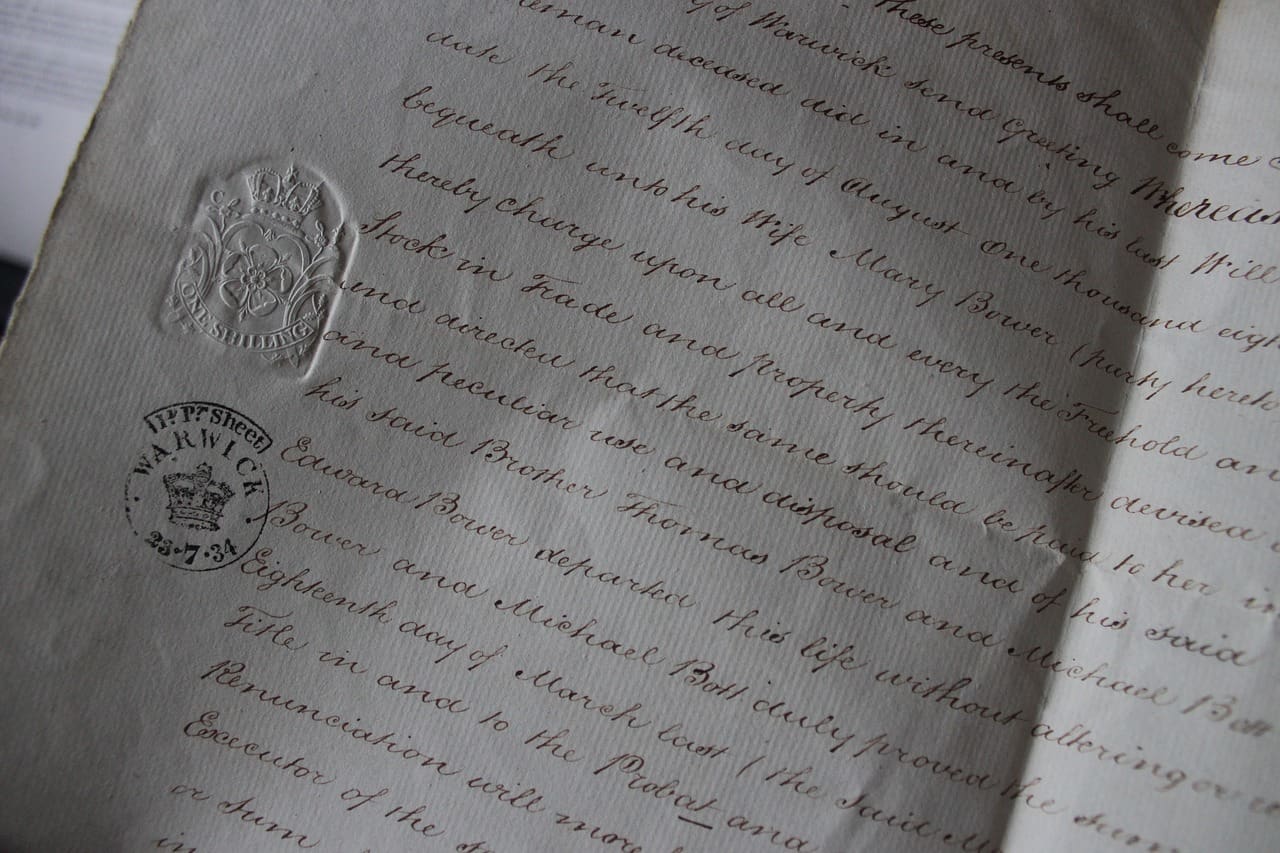

The Basics of a Last Will and Testament

The basics of a will include:

—Naming your beneficiaries, the people to whom you’re choosing to pass on your assets. If you have children, it’s essential to name all of your children, even if you don’t want one of your children to receive part of your estate. Not naming a child gives their legal guardian the right to contest the will.

—Stating how you wish your assets to be distributed after you’ve passed away, and to whom you wish to give your assets. If there are specific items you wish to give to certain beneficiaries, that information should be included in your will.

—Appointing an executor; that is the person you wish to carry out the details listed in your will. You should also appoint an alternate executor to serve if the primary executor is unable to carry out their responsibilities.

—Choosing two people (or three, in Vermont) to serve as witnesses to your will. Those witnesses should not be inheritors named in the will since that would most likely invalidate the will in court.

In Arizona, a will is settled under the supervision of a probate court as a way to assure the will is valid and that everything is done according to the wishes of the deceased person. Probate court includes legal fees, filing fees, publication fees, and more.

The Basics of a Living Trust

A living trust is much more than a will substitute. Unlike a will, which must go through probate, a living trust avoids the expense and delay of probate court. Instead, your living trust allows your loved ones to administer your estate privately from the comfort of their own home, and without the public notices involved in the legal processes of a will. Also, with a living trust your family will be able to immediately carry out the trust’s instructions and avoid the mandated waiting period required by a will.

The basics of a Living Trust:

—Naming your beneficiaries, just as you would with a will.

—A living trust starts while the owner (aka Trustor) is living, but continues after they have passed away. Your living trust will be administered by you until you die, and then your Successor Trustee (see below) will become the administrator.

—The living trust must be funded, meaning a legal transfer of the owner’s assets from the owner, into the trust. The trust, rather than the person, becomes the owner of all assets, which means, since the owner legally has no assets when they die, there is no need for probate court. Items like bank accounts, certificates, houses, and even vehicles will need to have their paperwork changed to transfer title or ownership into the living trust.

—You must name a Successor Trustee, that is, the person (or persons) who will manage the assets of the living trust after you, the Trustor, pass away, or in the event that you are incapacitated. The Successor Trustee must administer the living trust according to the Trustor’s wishes, and always in the best interest of the beneficiaries.

Benefits of a revocable living trust:

—Privacy. No public notices, no court sessions

—Immediacy. No court-mandated waiting period.

—Avoid probate. No probate court costs.

—Help if you’re incapacitated. Unlike a will, with a living trust in place—in the event that you become incapacitated—your Trustee can immediately begin making financial decisions regarding your estate. No waiting, no need for court intervention.

There are many other benefits, but these are the basics. We mentioned at the beginning of this blog post that for two generations we’ve been helping families prepare the legal documents required to pass on assets of their estates. Our background has led us to strongly prefer using a Living Trust rather than a will. And specifically, we highly recommend a Revocable Living Trust as your best option. Click here to learn why a Revocable Living Trust is our go-to choice in planning for the future.

If you’ve got more in $75,000.00 in assets (including your home), those assets should be legally protected from loss in the event of unexpected accidents or incapacitation. And your estate should be protected so that it can be passed on to the next generation. If you’re located in the greater Phoenix Metropolitan area and you’ve got questions, we welcome your inquiry. If you choose to work with our Phelps LaClair offices, we’ll carefully examine your financial portfolio and help you create a strategic estate plan that gives the best tax breaks, sets in place the best protection for your children or stepchildren, and much more. Now that you’ve got the basics of Wills and Living Trusts, it’s time to delve deeper and let us create a pathway that is tailored perfectly for your financial portfolio.

Images used under creative commons license (Commercial Use) (Pixabay) Mzmatuszewskio