06 Jun How Do I Start My Estate Plan?

Starting an estate plan can feel like a daunting task, especially if you’re a beginner and the idea is foreign to you. However, making an estate plan is absolutely essential, and you should not put it on the back burner. More people than ever are realizing why tools like wills and trusts are important—even for the younger generations.

Yes, there are a lot of details involved. But don’t worry! It’s a process, not a one-time event. You don’t have to figure it all out in one afternoon, and we’re here to help you along the way. At Phelps LaClair, we’re familiar with every aspect of estate planning, because it has been our specialty for decades. We value a personal approach, and we always take the time to figure out the best ways to help you accomplish your goals.

Let us make estate planning easy for you! To get started, first we’ll go over a simple estate planning scenario with basic steps for beginners to lay the foundation for a comprehensive plan. When you’re done with this and ready to deep-dive into more information, sign up for our webinar and you’ll receive a chance to schedule free consultation at one of our Phoenix area offices.

Estate Planning for Beginners: A Sample Scenario

Our hypothetical couple for this exercise will be Bob and Betsy – a married couple with two children, a few pets, and an estate estimated to be worth around 2 million. When the couple sits down in our office for a consultation, the first thing we would ask is what their goals are. What’s the one most important thing you’re trying to accomplish with your estate plan?

Bob and Betsy have three main goals. They want to:

-

-

- Leave an equal amount of money to each of their children

- Pass down their family vacation home

- Avoid probate and taxes as much as possible

-

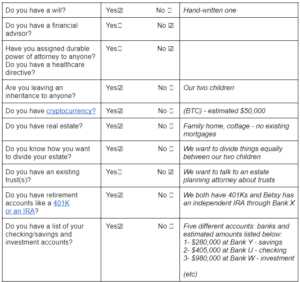

Since our hypothetical couple brought along a worksheet they already filled out at home, we had reference points for our discussion. The worksheet helped us quickly identify their needs so we could discuss things like which types of trusts would best suit their goals, how to go about leaving an inheritance to each of their adult children, and identify some possibilities for tax savings.

Let’s take a look at the checklist that Bob and Betsy put together before heading out to their appointment.

Simple Estate Planning Worksheet Example

Contact Phelps LaClair for an Estate Plan Consultation

As an estate planning law firm, we’re dedicated to developing an ongoing, lifetime commitment to you. We want your estate plan to actually do what you want it to do. We recognize that estate planning is much more about people than documents, which is why we tailor every plan to suit our clients’ needs. We will help you find the best approach to avoiding probate, minimizing taxes, and maximizing your legacy.

Call us at 480-892-2488 today for an appointment. It’s never too early to plan wisely.

Image by Eddie K from Pixabay on 5.22.2024 | used under the creative commons license for commercial use.