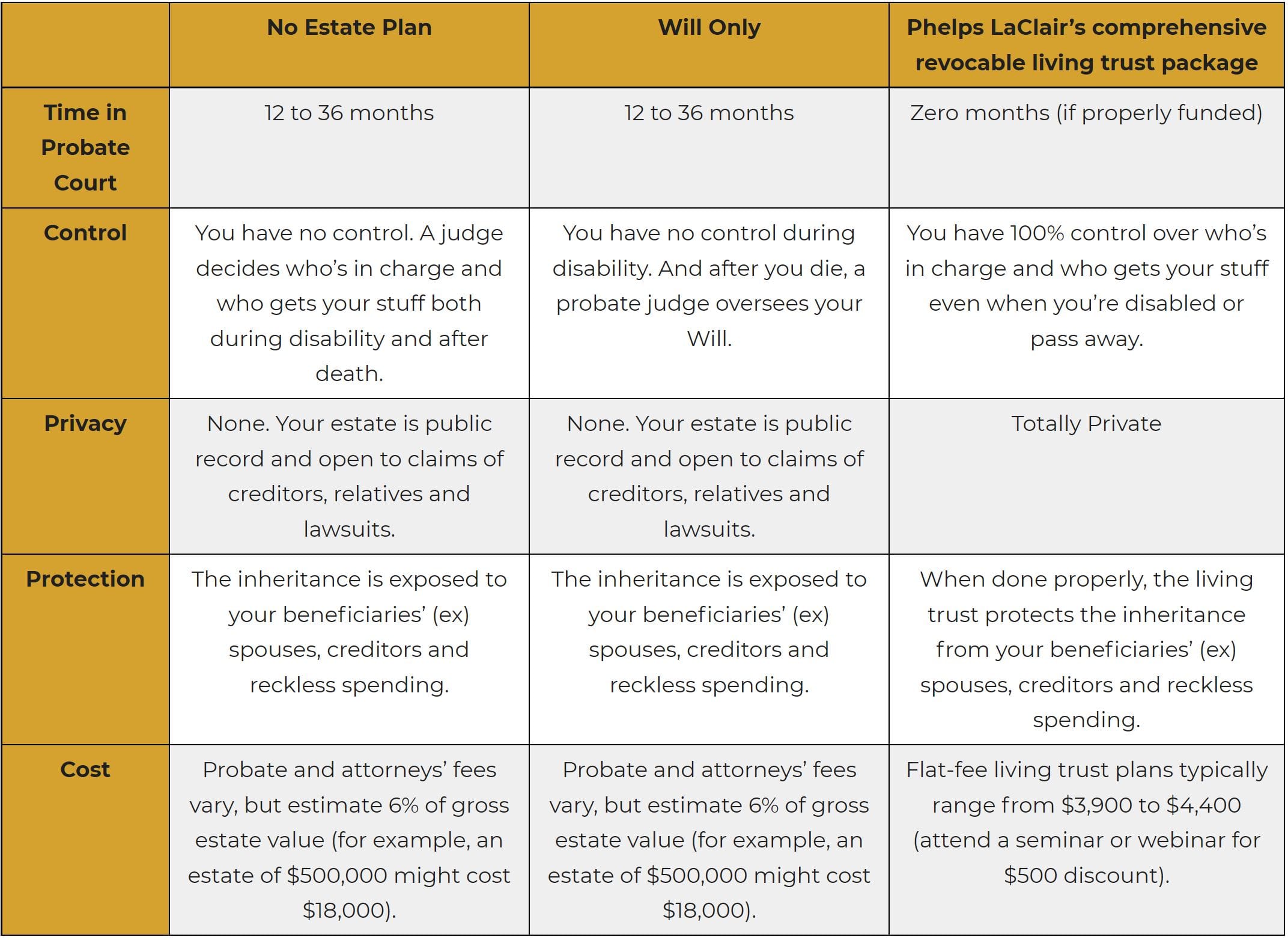

Compare having no estate plan vs. having a Will only vs. Phelps LaClair’s comprehensive revocable living trust package.

| No Estate Plan | Will Only | Phelps LaClair’s comprehensive revocable living trust package | |

| Time in Probate Court | 12 to 36 months | 12 to 36 months | Zero months (if properly funded) |

| Control | You have no control. A judge decides who’s in charge and who gets your stuff both during disability and after death. | You have no control during disability. And after you die, a probate judge oversees your Will. | You have 100% control over who’s in charge and who gets your stuff even when you’re disabled or pass away. |

| Privacy | None. Your estate is public record and open to claims of creditors, relatives and lawsuits. | None. Your estate is public record and open to claims of creditors, relatives and lawsuits. | Totally Private |

| Protection | The inheritance is exposed to your beneficiaries’ (ex) spouses, creditors and reckless spending. | The inheritance is exposed to your beneficiaries’ (ex) spouses, creditors and reckless spending. | When done properly, the living trust protects the inheritance from your beneficiaries’ (ex) spouses, creditors and reckless spending. |

| Cost | Probate and attorneys’ fees vary, but estimate 6% of gross estate value (for example, an estate of $500,000 might cost $18,000). | Probate and attorneys’ fees vary, but estimate 6% of gross estate value (for example, an estate of $500,000 might cost $18,000). | Flat-fee living trust plans typically range from $4,400 to $4,900 (attend a seminar or webinar for $500 discount). |