In Arizona, if you own a home or other assets worth more than $200,000, you need an estate plan to avoid probate court & protect your inheritance. We focus exclusively on designing and implementing Living Trusts and Wills. We have over 40 years of experience in Arizona, and we know what works and what doesn’t work when the time comes. We have created a free Estate Planning Seminars video series to help you understand why correct estate planning is so important.

Amazing advice and great work on our trust!

Thank you James for the amazing advice and great work on our trust! Your knowledge and insight made my wife and I feel extremely comfortable and confident.

- The Carroll Family

This FREE Estate Planning Seminars Video Series includes:

☑ Strategies for Avoiding Probate

☑ Why All Living Trusts Aren’t the Same

☑ Planning for Disability

☑ How to Protect Beneficiaries from Themselves

☑ How to Protect Beneficiaries from 3rd Parties

☑ How to Easily Keep Your Trust Up to Date

☑ & Many More Arizona Estate Planning Tips

Enter your email above and we’ll send you all 7 videos for Free. Or if you’re ready to discuss your estate plan now, give us a call for a Free Consultation – with no strings attached. It’s absolutely free with no obligation. Guaranteed!

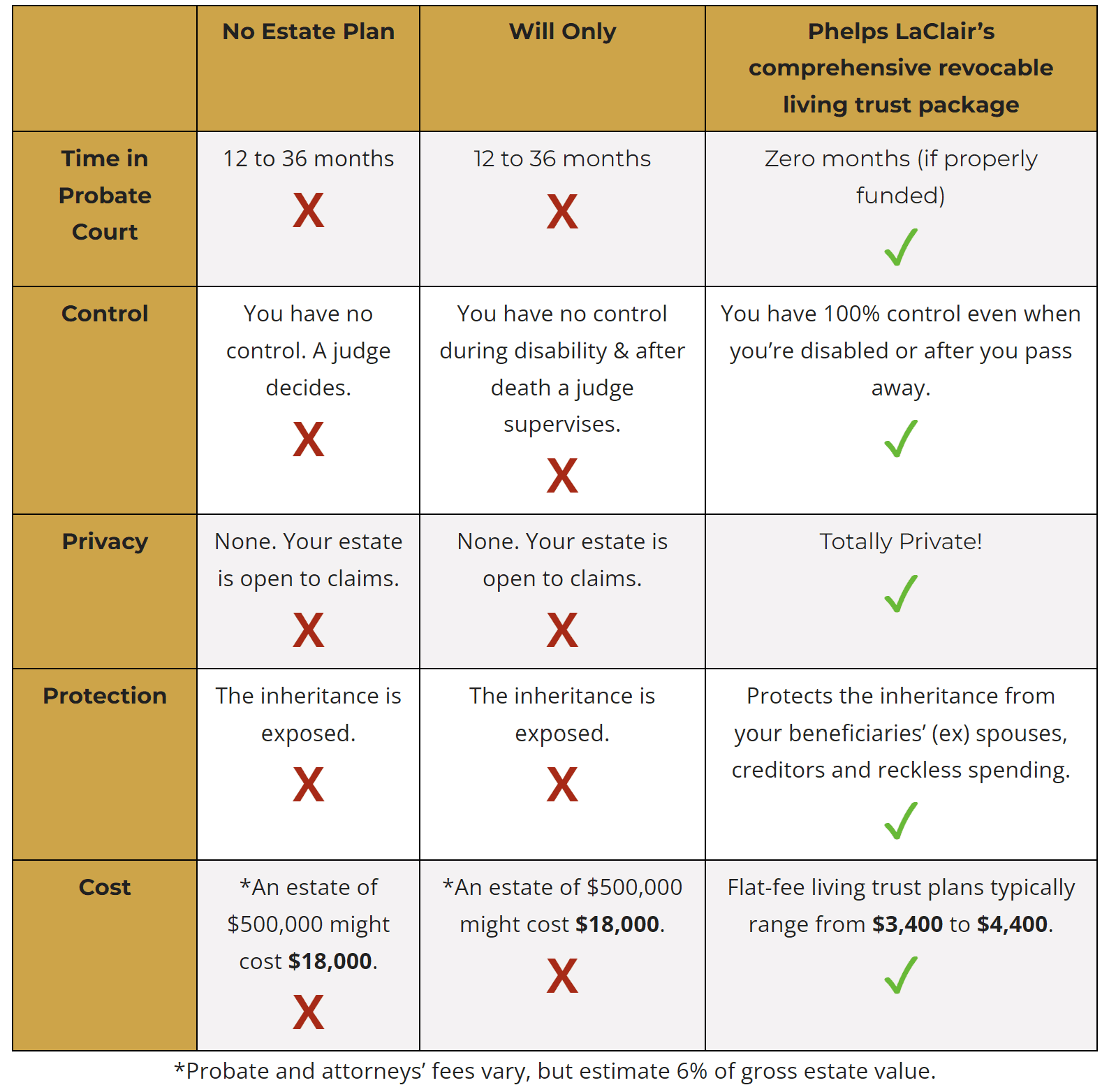

Comparing Estate Planning Options

Setting up your Estate Plan incorrectly can literally cost you and your loved ones Thousands upon Thousands of dollars, years of courtroom & legal hassles & stress & anxiety for all involved. This is not the time to DIY or trust just anyone to set up your estate plan.

While every situation is different, the table below gives you an idea of what’s at stake when setting up your Estate Plan (or failing to set one up at all).

| No Estate Plan | Will Only | Phelps LaClair’s comprehensive revocable living trust package | |

| Time in Probate Court |

12 to 36 months X |

12 to 36 months

X |

Zero months (if properly funded)

✓ |

| Control |

You have no control. A judge decides. X |

You have no control during disability & after death a judge supervises. X |

You have 100% control even when you’re disabled or after you pass away. ✓ |

| Privacy |

None. Your estate is open to claims. X |

None. Your estate is open to claims. X |

Totally Private!

✓ |

| Protection |

The inheritance is exposed. X |

The inheritance is exposed. X |

Protects the inheritance from your beneficiaries’ (ex) spouses, creditors and reckless spending. ✓ |

| Cost |

*An estate of $500,000 might cost $18,000. X |

*An estate of $500,000 might cost $18,000. X |

Our flat-fee living trust plans cost a fraction of the probate court fees required for those who only have a Will or no estate plan at all (attend a seminar or webinar for $500 discount). ✓ |

*Probate and attorneys’ fees vary, but estimate 6% of gross estate value.

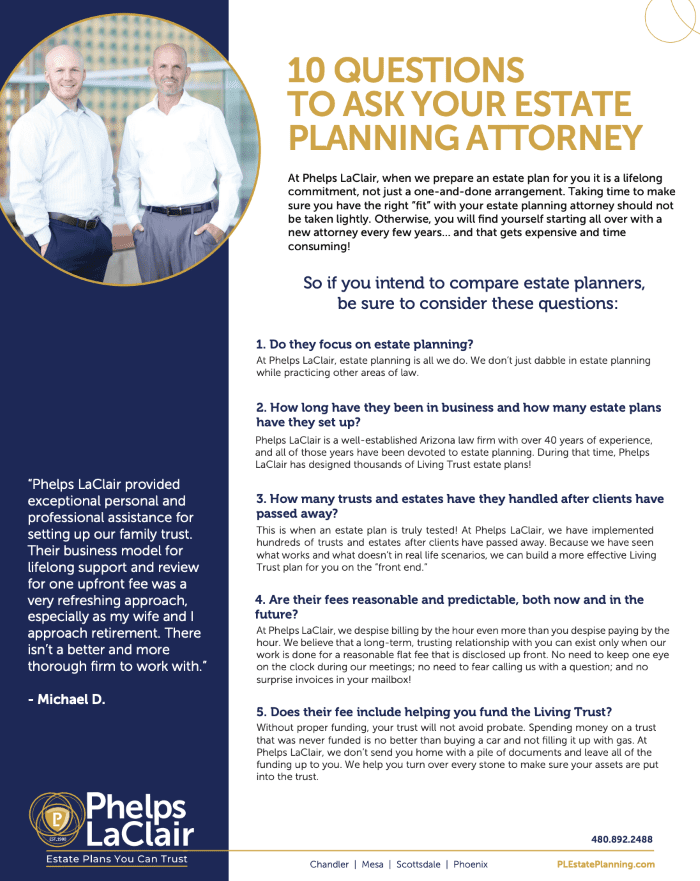

BONUS: When you enter your email above, we’ll also send you the 10 QUESTIONS TO ASK YOUR ESTATE PLANNING ATTORNEY absolutely free. These 10 questions are critical to ensure your estate plan will be set up fairly and correctly, at a reasonable cost. This Free document will cover questions such as:

- Do they focus exclusively on estate planning?

- Are their fees reasonable and predictable, both now and in the future?

- Will the attorney (not the paralegal) take the time to customize the right plan for you?

- Do they have advanced tax degrees and offer advanced level tax and wealth preservation planning beyond a Living Trust?

We Were So Impressed

Phelps LaClair was not what we expected -- they were so much more! And our attorney was amazing. He was professional, kind, patient and thorough. Our trust is comprehensive and exactly what we asked for. We were so impressed with our experience we recommended Phelps LaClair to our son and daughter-in-law.

- Lindie N.

Don’t put it off any longer!

Probate court is much more expensive than our estate plans. Enter your email address and we’ll send you all 7 Estate Planning Videos & the 10 Questions to ask your Estate Planning Attorney for Free.

If you’re ready to discuss your estate plan now, give us a call for a Free Consultation – no strings attached. It’s absolutely free with no obligation. Guaranteed!